What We See in the Markets: Crypto Market Rally, BTC and ETH Movements, and Potential Trends

Good Morning and Happy Monday from Cumberland APAC! Crypto has rallied for the past three weeks, with the overall market cap increasing from $1.03T on October 23 to $1.38T as of right now. For the most part, this move came in two parts; the week of October 23rd, and the week of November 6th. From a distance, this looks like a single movement, but the two weeks were actually quite distinct.

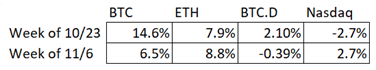

The week of 10/23 was a BTC move. This was the week where the market became convinced that a BTC spot ETF was not just likely, it was fairly imminent. BTC rallied 14.6%, the second-largest move in a year. The rest of the market followed BTC, but sluggishly. ETH only rallied around 8%, and ETHBTC slipped to two-year lows. BTC dominance increased from 52% to 54%. Part of the challenge: stocks were struggling, with the Nasdaq down 2.7% on the week and looking vulnerable.

Last week was a different type of rally. It wasn’t just a BTC rally, but a crypto rally. Part of this was due to equities, rallying for a second consecutive week and approaching this Summer’s highs, putting the wind at crypto’s back. A lot of attention will be paid (including a few paragraphs down) to the Blackrock ETH ETF filing, but it wasn’t just ETH. In fact, while ETH was up 9%, many L1s/L2s actually outperformed it; SOL +34%, MATIC +16%, and AVAX +14%. It was a risk asset rally, not just an idiosyncratic BTC rally.

We don’t know if the market is going up or down (we have our suspicions), and more to the point, if we do get rallies, we don’t know what kind they will be. If one is expecting the BTC spot ETF to be the story for the next three months, a BTC-heavy position would be prudent. If we see a broader risk rally, with crypto in focus because of said ETF, then blue-chip alts would be expected to outperform due to Beta and their recent lag to BTC. It’s a big question. All funds want to put up green numbers, but almost as important is outperforming the benchmark, BTC. Length is important, but so is where it’s held.

For lack of a better way of phrasing it… ETH feels special here. While the market seemed to have been caught off-guard by the ETH spot ETF filing, it really shouldn’t have been. The class of Institutionally-investable cryptoassets has clearly been a short-list of just BTC and ETH for some time now; no other cryptoasset seems likely to get similar institutional attention in the near-term. This means that ETH gets to sit in the middle of the Venn diagram, and could perform well on either an idiosyncratic BTC-ETF rally, or a broad risk asset rally. If the BTC ETF is launched and gets more subscriptions than expected, ETH should surge as traders look to play it back on a future ETH approval and listing. If a strong Nasdaq combined with crypto in general coming into vogue off the back of an ETF leads to a broad crypto rally, ETH should do well there, too.

From a charts perspective, ETHBTC just bounced off .052, the same level it bounced off in 2022. While the rally in ETHBTC was healthy, it wasn’t particularly large and doesn’t feel overdone in the least; it had six weeks with larger increases just this year, and its current level, .0555, is still extremely low compared to where it’s spent most of the year. Traders have been hesitant to position in ETHBTC while BTC was going vertical, because it felt like catching a falling knife, but that knife has bounced over the past two weeks, and so we would expect to see entrants here.

Moving away from ETH and BTC, playing for catchups has been a pretty successful strategy in this market. Over the past few weeks, the obvious catchup candidates have been MATIC and AVAX; two blue-chip L1s which had shown low volatility in the face of the broader rally, not to mention the outperformance in SOL (+93% since Oct 23). They’ve both woken up in the last several sessions, and AVAX has actually fully caught up to SOL, +90% since Oct 23, while MATIC is +49% over the period. Notably, the bulk of these rallies has occurred in just the last four days; as of Thursday, both of these names were essentially in-line with ETH. Playing catchup trades gets more difficult as the strategy plays out; eventually, the laggards it points to are lagging for a reason.

For anyone who has read this far, thanks for staying with us. We will be at Singapore Fintech Festival this week, so if you are in town, please reach out to a Cumberland relationship manager. Happy Trading!