Weighing the Ultimate Blockchain Endgame

WHAT MAKES FOR A SUCCESSFUL AND INVESTABLE L1?

Cumberland Counterparties,

Although Bitcoin and Ethereum continue to dominate the Layer 1s (L1) in terms of network security, active users and market capitalization, they also face challenges, namely slow speed, limited throughput and high gas fees. This has created opportunities for a number of emerging chains. Those that have marketed themselves as faster and cheaper alternatives have attracted a significant share of new developers and decentralized applications (dApps), along with strong community engagement, which has in many cases driven impressive performance of their underlying governance tokens.

With an ever-expanding list of contenders – lovingly known as “ETH-killers” – it has become increasingly challenging to determine which chain will ultimately win out and dominate the space. What qualities make for a successful L1? Will there be room for multiple chains? How does one assess the relative value of these L1s? And, perhaps most interesting, what is the ultimate blockchain end-game?

In this piece, we outline our framework for assessing the value of this growing community of L1s and invite readers to share their thoughts on this topic.

L1s and their dApps

L1s are native blockchains on which dApps exist: L1s can be thought of as the prime real estate of the crypto world, while dApps are the storefronts. There are currently 5-10 major L1s, most of which utilize the Proof of Stake (PoS) method of validation (see Appendix 1). Ethereum is one of the best-known L1s (soon to be PoS), whereas AAVE and SUSHI are examples of the tokens for the dApps that are built using the Ethereum chain. While valuations for L1 governance tokens are generally very challenging to assess, investors in these protocols are in the unique position of being able to own a piece of the underlying blockchain in a way that doesn’t exist in the traditional internet space.

The bar for success is incredibly high, limiting the number of platforms able to achieve critical mass. The leading L1s generally command far higher valuations vs typical underlying native dApps (for example decentralized exchanges or borrow/lend platforms, where competition is intense). This is because L1s ofer greater permanence, network efects, composability of underlying core dApps, and pure exposure to growth in the network.

L1 Key Performance Factors

Beyond optimizing for the scalability trilemma (see Appendix 2) – decentralization vs performance vs security - we pose the following as critical “key performance” factors in assessing the fundamentals of an L1, listed from most to least important: • Developer adoption – ease of use creates eficiencies and development speed, and not surprisingly, developer-friendly tools often attract founders from one particular L1 to another. This includes the choice of smart contract language (e.g., Solidity for Ethereum) and runtime environment. In the case of Solana, for example, the primary language is Rust, a relatively common programming language that eases developer adoption.

- Decentralization – a larger number of validator nodes leads to a more robust network, generally at the cost of speed. Among the leading L1s, Ethereum and Bitcoin are seen as the most decentralized while Solana is generally considered to be the least decentralized - at least for the moment. A lower degree of decentralization limits censorship risk given that for PoS L1s, generally an individual or group can censor the network and prevent finalization with 33% of the network’s validation capacity. Higher financial costs for validators (in terms of hardware cost and minimum staking amount) and technical knowledge requirements to manage the machines, generally lead to a more centralized validator base. Another factor to consider, is that smaller delegators tend to choose larger, more reliable and established validators, which tends to lead to concentrated holdings and therefore lower levels of decentralization.

- Transaction costs – with ETH gas fees currently 100-200 gwei (1gwei = 0.000000001 Ether), the average Uniswap transaction costs $100+. This is prohibitively high for small trades and DeFi activity such as yield farming. These high transaction costs have been driving investor’s attention to newer platforms that ofer transaction costs as low as $0.01. Ethereum’s L2 platforms (see Appendix 2) are a significant improvement in this regard.

- Total value locked – (the capital locked into the various applications in the L1) – a useful indicator of underlying activity and adoption. Ethereum currently leads this race with ~$175bn in TVL, compared to ~$14.5bn in Solana, $13bn on Avalanche, and $11bn on Terra.

- Foundation war chest – with ~50% of tokens originally allocated to the foundation and community reserve fund, Solana began life with a war chest worth over $50bn at today’s valuation. This pool of liquidity has been used to fund new developer teams and has created an ecosystem of early core apps (Mango, Raydium, Serum) that are bootstrapping the ecosystem, building community and attracting new “sticky” projects. Similarly, the recent incentive programs across Fantom ($600m), NEAR ($800m) and Harmony ($300m) will be important in encouraging user adoption and core application development. In the case of Fantom, the $370m incentive program announced in August has been focused on protocol teams and allocates more rewards to projects with higher TVL.

- VC adoption – as with Foundation grants, the support of high-profile investors is an important driver. For Solana, the support of Multicoin Capital and FTX/ Alameda Research has been critical, particularly in the establishment and support of Serum, a decentralized trading platform built on Solana. Similarly, the Algorand ecosystem is finding support from a $100m fund launched earlier this year by Arrington XRP Capital.

- First mover advantage – while Ethereum clearly lags in terms of throughput and transaction cost, thereby severely impacting the network’s usability during busy periods, the first-mover advantage remains extremely powerful and continues to support the chain’s dominance. Core applications are far more entrenched and increasingly interoperable – users have large parts of their crypto portfolios invested in ETH and feel comfortable with the ecosystem and its core dApps - which drives user stickiness.

- Governance tokens used as a medium of exchange – “ETH is money” has become an increasingly popular statement across podcasts and Twitter. This narrative has been reinforced by recent developments in the NFT space. OpenSea, the largest decentralized marketplace to buy and sell NFT’s (recently valued at $10bn), is one of the first proper cases of crypto (ETH) being used to facilitate the exchange of “goods and services.” Major auction houses such as Sotheby’s have also begun allowing bids on both NFT and traditional art work in ETH, with the ETH price of art being quoted on their currency board among other major foreign currencies. This has spread across other L1s in early blockchain native NFT platforms, such as Randomearth in the Terra ecosystem. This gives ETH a permanence and utility value that is (at least for now) perhaps more credible and “crypto native” than early notions of using bitcoin to buy pizza.

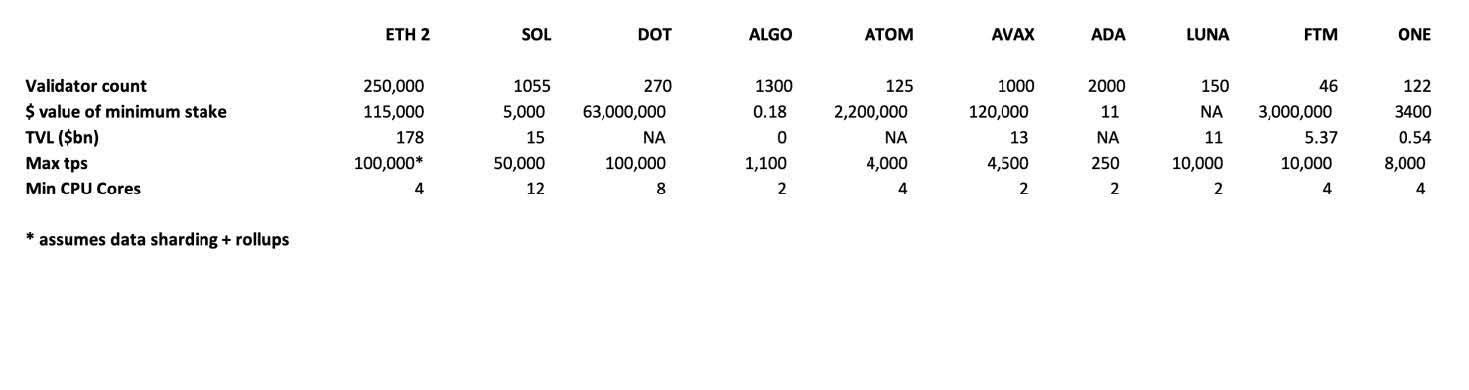

Below we assess ten platforms using these factors. In general, developers, users and investors have tended to place a premium on performance, particularly given gas costs and the limited throughput of the Ethereum network to date. While still in development, Eth2 is clearly in a good position relative to other L1s in terms of both performance and decentralization.

A good example of an L1 that positively incorporates many of the characteristics outlined above is Avalanche (AVAX). Avalanche is a PoS L1 with one of the highest throughput speeds (~4500 tps) and a transaction finality of sub 2 seconds. Avalanche allows any developer to create their own app-specific blockchains and supports multiple virtual machines, most importantly the Ethereum Virtual Machine, allowing for a high degree of decentralization and interoperability. The Avalanche foundation recently started Avalanche Rush, its $180m incentive program, that has onboarded leading DeFi projects Aave and Curve. This incentive program has helped attract capital to its core dApps, such as Trader Joe, a leading DEX and staking platform, which has grown its TVL from $20m in early August to over $2bn at present. Other core apps on Avalanche include BenQi (borrow/lend), YieldYak (yield farming autocompounder) and Snowball (auto-compounder and incubator). While Avalanche has average gas fees that are far lower than Ethereum, it also has far less demand for block space. In the last month there were a few days where gas prices spiked to $140 per transaction as a result of short-term spikes in demand for block space.

Similarly, on Solana, core apps such as Raydium, Marinade, Saber and Sunny are seeing strong initial momentum, supported by low gas fees and helpful products such as liquid staking (ie staked SOL earning a yield but tradeable in the form of mSOL) on Marinade. Solana is also experiencing an increase in NFT volumes, with monthly sales topping $140m in October from a standing start in August – albeit still far below the $1.7bn logged on Ethereum last month. Low fees on Solana are also supporting the burgeoning gaming ecosystem, which has become a major focus for investors. On that point, Solana Ventures, Lightspeed and FTX recently announced the launch of a $100m gaming fund.

In the short term, investors clearly are attracted to the high expected upfront returns and low transaction costs. Longer term however, it remains to be seen how viable some of these core protocols will be once the incentive programs end and they are forced to compete head-on with the more established players such as Aave, an early “Blue chip” DeFi protocol which is already expanding from Ethereum into other L1s and L2s on multiple chains, and enabling cross chain collateral in their recent v3 update.

On a similar note, L1s will ultimately have to compete with Eth2 which is being introduced sometime in 2022. Eth2 is arguably the most promising solution to a fully performant, decentralized and secure blockchain, given it has already achieved significant user and developer adoption. Based on current network activity, Ethereum is also on track to be ~3% deflationary post Eth2 given the combined impact of EIP-1559 fee burn and lower net emissions, which is clearly very attractive from an investor perspective.

Can multiple L1s co-exist in a cross-chain future?

It was originally thought that the L1 ecosystem would ultimately be “winner takes all,” given powerful network effects and composability. More recently, however, sentiment has shifted towards the increased likelihood of a multi-chain ecosystem, enabled through increasingly sophisticated bridges built between various L1s. This has the potential to break the single-network effect, allowing a degree of specialization and a choice of speed over decentralization and safety, which leaves L1s such as Solana well suited to less “mission critical” use cases such as NFTs and gaming.

We see this oligopolistic multichain future (i.e., many chains but a handful of major players) as fairly likely, with a number of L1s showing sufficient early-stage momentum to create critical mass. These ecosystems are increasingly being supported by cross-chain bridges and multichain DEX protocols.

How do multichain bridges work? These bridges generally hold assets on one L1 (for example, USDT on Ethereum) and release a wrapped version on another (eg USDT.e on Avalanche). In other words, the user deposits funds into the bridge and the bridge then represents those funds on another chain. These funds can be withdrawn, but this often involves non-negligible wait times – ranging from minutes up to a week depending on the chain or layer 2 you are withdrawing from. Bridging a transaction also involves a fee to the bridge, along with gas fees, which at the moment can be fairly material on L1s such as Ethereum.

Cross-chain bridges such as Avalanche Bridge, Binance Bridge and Wormhole (the bridge between Solana, Ethereum and Cosmos), allow assets to move between L1 and L2, potentially unlocking far more composability within DeFi. For example, one could bridge UST from Terra onto Ethereum and add it to a pool on Curve, or bridge assets to Terra and deposit UST in Anchor to create a yield currently close to 20% APY. NFTs could be wrapped and traded on other chains in order to access new pools of buyers and sellers. As with centralized exchanges, assets on a multichain DEX could be aggregated as margin, allowing for far greater efficiency. Given ESG concerns toward bitcoin, investors could also trade wrapped BTC (WBTC) on Ethereum as an “eco-friendlier” alternative.

With the proliferation of L1 platforms, dApps are increasingly diversifying risk and hedging their bets by building on multiple chains. SushiSwap, for example, is currently deployed on 13 chains. Additionally with effective bridges and ever-improving interoperability, developers can expand their businesses into new, less competitive marketplaces on competing L1s. It may well be preferable to have an early-mover advantage in building an NFT marketplace on Avalanche for example, as opposed to competing with established incumbents on Ethereum. Bridging is therefore a critical enabler to the viability of L1 ecosystems outside the top 3-5 players and is incredibly important in the way we think about valuation, which we discuss below. Rather than winner takes all, bridges support the viability of L1s beyond the major platforms, reducing the fair valuation of the leading L1s to the relative benefit of the long tail. Methods to determine L1 valuations L1s are notoriously difficult to value, encompassing an overlapping hybrid of utility valuation, “store of money” valuation and more traditional yield or “burn” return approaches.

- Utility valuation – just as the US Dollar has underlying demand as the world’s reserve currency and the dominant currency of international trade, ETH is in demand as it must be acquired in order to pay for things like gas, Bored Ape Yacht Club NFTs or DeFi collateral. This creates demand for the underlying token which ultimately gives it utility value. Utility valuations are incredibly challenging to assess, but the Fisher equation is a useful tool in valuing an L1 similarly to how one would value a traditional currency: MV (market cap velocity of money) = PQ (price quantity, or revenue, GDP) In this sense, the low velocity (staking, cold storage) and the high “GDP” (gas, NFTs, collateral) of the Ethereum microeconomy support a buoyant ETH market cap.

- “Store of money” valuation – this approach is popular with Bitcoin, given the wide acceptance of the “digital gold” narrative. Again, this is incredibly subjective, but one can compare the $1.3tn market cap of BTC (zero yield, “sound money”) to Gold’s market cap of $10tn, and see that with falling real yields, BTC should be seen as relatively more attractive.

- Yield valuation – this approach analyzes the yield generated for token holders which is generated either via buy and burn, such as for ETH post EIP-1559 where the network burns a portion of fees generated, or via inflationary issuance to nodes and delegators where the network usually mints tokens to incentivize staking. Arguably, fee or cash flow generation should be considered a higher-quality yield than inflationary token minting, as the latter ultimately devalues the wider network while increasing the relative share for stakers.

Although the above approaches offer a simple framework in theory, valuating L1s remains an incredibly complex task in practice. Further complexities arise from the differences between circulating versus fully diluted valuations and challenges stemming from community funds, which can either be canceled subject to governance votes or used to invest in and grow the network.

In reality, most L1s trade on momentum, loosely driven by progress in the key performance indicators discussed earlier (e.g., growth in dApps, TVL, developer and VC support) or improvements in deflationary dynamics (such as with ETH post EIP-1559 this August). Most L1s outside of Ethereum or Bitcoin are loosely viewed by the market as competitors to Ethereum and as such, are valued using Ethereum as a benchmark. On this basis, the Solana valuation at $120bn (fully diluted vs ETH at $500bn) implies that the market sees roughly 1/4 of the value in Solana or, put differently, sees a 25% chance Solana can achieve similar levels of success.

Conclusion

We believe the most likely outcome is that of a multichain future, with increasingly sophisticated bridges connecting a number of L1 ecosystems, some of which will be used for more general purposes, and some for specialized purposes.

At the dApp level, we see developers opting for a multichain approach, and we feel it makes sense for this to be embedded within the dApps themselves (e.g., staking and lending within Sushiswap enabled by wrapped assets and cross chain collateral across various L1s). We therefore expect the wider user experience to be increasingly L1 agnostic, with cross-chain complexity removed via userfriendly front-end applications such as MetaMask or aggregators such as 1Inch.

While we see full interoperability taking time from a technical perspective, this view leans toward a more open, less “walled garden” crypto ecosystem, with diminishing first-mover advantages and increasing intra L1 network effects. This ultimately suggests a relatively lower valuation accruing to incumbent L1s (compared to a ‘winner takes all’ outcome), which from an investment perspective suggests a convexity in newer L1s, particularly for those with strong early momentum.

The key risk to this view is the impact of Eth2 and further growth in Ethereum-centric layer 2 scalability solutions and whether a highly performant, low fee iteration of Ethereum will be sufficient to severely damage the viability of challenger L1s. Overall, we tend to think current challengers will have built sufficient critical mass by mid-2022 to be relevant and credible over the medium- to long-term. However, Eth2 and the launch of. Layer 2 scaling solutions like zk-rollups and optimistic rollups may well close this window of opportunity for challengers, which will mark an interesting inflection point for the ecosystem.

Appendix 1 – Proof of Work vs Proof of Stake

The original L1s were designed using Proof of Work (PoW) which meant that miners had to solve a random cryptographic puzzle in order to mine Bitcoin and Ether. Given the rise in competition, this eventually led to ever more sophisticated application-specific hardware and lowcost power being required to run economically viable mining operations. The logic of this PoW approach was to introduce the concept of economic security, designed to make an attack on the network so resource-intensive that it would be extremely expensive to attempt a 51% attack (the share required to control the network). One of the key design features is that it is more profitable to spend those resources to support the network than to attack it. Given the inefficiencies and eventual ESG concerns around this model, most of the leading blockchains are now Proof of Stake (with Ethereum transitioning sometime in 2022).

Proof of Stake networks essentially allocate votes and staking rewards in proportion to the value staked in validation nodes, with smaller token holders often able to delegate their tokens to particular validators, which generally take a small fee from the delegator’s staking rewards. In the Proof of Stake model, generally one would need to own 67% of staked tokens to control the network. Economic security in Proof of Stake is enforced by two mechanics - slashing and ownership of the asset.

In the case of nefarious activity, validators will have a percentage of staked assets taken away from them through “slashing” while the assets required to carry out the attack will be devalued by the market’s negative reaction to the attack.

Appendix 2 – The Scalability Trilemma

The scalability trilemma, first proposed by Vitalik Buterin, posits that one can have at most two of the following three attributes – decentralization, performance and security.

Traditional blockchains including Bitcoin and Ethereum offer a high degree of decentralization and security but not scalability, given that every node must validate all transactions. High throughput chains like Solana achieve speed and security by sacrificing decentralization through high validator costs and relatively lower validator counts.

This trilemma has historically been re-enforced by the difficulty of maintaining large node counts as the speed of the network increases. In the case of Solana, although there are ~1000 validators at present, each node requires expensive high-performance hardware, leaving 70% of the network capacity in the hands of the largest 100 validators, thereby limiting decentralization. The network also supports parallel transaction execution and allows the production of new blocks before finality is achieved. This strategy is ideally suited to “non-mission critical” activities such as gaming, NFTs, and perhaps retail yield farming, but clearly has limitations for industrial-level applications. In fact, in September the network suffered an outage for 12 hours as an extreme spike in network activity proved too great for the validators running lower-end hardware. It is important to note that Solana launched its “mainnet beta” in March 2020 and so is still a relatively new chain, hence some of these issues may well be solved over time.

More recent developments, such as multi-chain ecosystems, offer decentralization and speed but are considered less secure given the vulnerability to an attacker achieving a consensus node majority in one of the individual chains. What solutions are available to deal with the Trilemma?

- Sharding – The approach under Eth2 is to create 64 shards, or sub-chains, which will each reach consensus internally (i.e., a smaller validator set), but will run simultaneously, using parallel processing. Essentially, the network will be able to verify multiple transactions at a much faster individual speed. According to the Ethereum Foundation, this will result in transactions per second on Ethereum rising from ~12 tps at present to up 100,000 tps. With the launch of Eth2, the network will also fully migrate from PoW to PoS.

- Random Validator Selection – Algorand for example randomly selects a subset of 1000 validators from the wider group, such that reaching consensus is far quicker than under a classically decentralized system given far fewer “active” validators. Security remains robust as it would be virtually impossible for an attacker to predict the validator set and therefore coordinate an attack upon the network. That said, it is still fairly early days for Algorand in terms of user adoption, dApp proliferation and Total Value Locked (TVL). Harmony also takes a similar approach with a sharded PoS model, which uses sharding to achieve a finality of around 2 seconds. The network architecture encourages greater decentralization through the allocation of block rewards based on median tokens staked, thereby reducing the incentives that would otherwise lead to over concentration among validators.

- Roll-ups – Ahead of Eth2, the Ethereum network is increasingly using Layer 2 (L2) solutions to deal with its current short comings. Essentially, these involve applications that process transactions outside of the Ethereum base layer. One of the most common methods of achieving this is the use of “rollups” which consist of a smart-contract execution environment that processes transactions off-chain and later rolls them up to settle on the base layer. Current rollup implementations consist of either “validity proofs” or “fraud proofs” with Arbitrum, Optimism and StarkWare leading the industry. Arbitrum for example can complete sub-second trades on Uniswap with a fee in the range of $1-3.

Download the full report here.

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this publication or document, or on or through https://cumberland.io/, is for informational purposes only and is provided without charge. Cumberland is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information is being distributed as part of Cumberland’s sales and marketing efforts. Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION. The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks. Any person seeking to invest in or trade virtual currencies should do so only after engaging in their own research and obtaining their own advice as to whether virtual currencies may be appropriate in the context of their individual circumstances.

Cumberland is a principal trading and market making firm, and Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will be acting solely in its own best interests, which may be adverse to the interests of such persons.