Polygon: Onboarding the Next Wave

Polygon Technology is arguably the leader in the Ethereum L2 space and offers a secure, cost-efficient scaling platform for Ethereum projects. Best known for its PoS commit chain (technically an L1) – which leads the Ethereum L2 pack in terms of transactions, addresses and TVL – Polygon has continued to innovate to deliver novel solutions to the dApp community. Polygon has been highly acquisitive in recent years, using its token and cash reserves to make a number of strategic investments, particularly in the zk-rollup space.

In this report, we look at Polygon’s growth strategy and emerging product suite and try to understand how the project and investment case likely evolve going forward, particularly given the dramatic technological improvement we believe is coming to the Ethereum L2 space over the next few years.

Polygon's Growth Strategy

Polygon is focusing on an early ‘land grab’ of dApp, developer and user mindshare, with a focus on gaming, DeFi and web3.

In particular, the company has been extremely active in terms of building partnerships with web2 leaders. Recent high-profile partnerships include joining Disney’s accelerator program, and working with Meta on NFTs for Instagram, Mercedes-Benz on a data sharing platform, Stripe on payments and Reddit, DraftKings, Adobe and the NFL on NFTs.

Positioning themselves as a blockchain partner for traditional businesses (which we refer to rather loosely as ‘web2’, though in reality many of these businesses are not tech firms), possibly in return for some form of rent, seems to us to be a smart approach with significant upside. It’s clear that web2 is focused on the opportunity: just last week, Disney published a job posting for a lawyer to work on NFTs, blockchain, metaverse and DeFi. More specifically, Polygon recently announced a loyalty-focused partnership with Starbucks, where customers can earn NFTs, allowing them access to events and other benefits. Starbucks has ~$1.7bn in customer voucher credit and 27 million reward members, so moving its payments/credits and loyalty program on chain could be material for Polygon. It’s also a powerful use case if one of the world’s biggest brands can use web3.

What could web2 be worth in revenue terms?

From a bottom-up perspective, we can try to size the opportunity as [number of web 2 chains/dApps * revenue per chain/dApp]. This is extremely difficult to accurately assess, especially as the value is highly specific to the underlying business, but below we consider a few key use cases:

Brick and mortar retailer - eg Chipotle (FY21 revenue $7.5bn)

- Payments - ~0.2% paid to major payments networks which could be circumvented

- Loyalty/marketing – generally ~0.1% paid to third party service providers

- = 0.3%, or $20m pa opportunity

Media brand (e.g., Disney with FY21 revenues $67bn)

- NFT creation & trading - $200-1bn+ initial creation, 2% secondary trading fees

- We arrived at this number by comparing it to Nike (which generated $185m last year in NFT revenue from digital sneakers), the total value of Bored Apes (currently total value of $1.6bn), and NBA Topshots (which generated over $500m in its first 6 months and continues to generate around $40m per month).

- Loyalty - ~ 0.1% = $70m

- Online content purchases using stablecoins - payments savings of 0.2% of revenue costs across say 10-20% of revenue base = $10-20m

- Disney Coin – yield on USD collateral if stablecoin (3% of AuM * $1bn = $30m), value generation from holding foundation position if non-stable (eg $5-10bn FDV, foundation holds 20%)

- NFT/Disney Coin creation value $1bn+, revenue generation pa $100m

TradFi institution - (e.g., AllianceBernstein with $700bn AuM, FY21 revs $4.5bn)

- In June this year, Alliance Bernstein signed an agreement with Allfunds Blockchain to use blockchain for operational savings given blockchain settlement and automation

- Assume back office costs of $50m (~15% of total cost base) and savings of 10% across staff and technology = $50m, along with significantly lower operational risk

The above indicates clear potential value generation for non web3 companies venturing into blockchain, particularly for those with significant IP. Current use cases focus on payments, cost savings, loyalty and NFTs but there are plausibly far wider applications as this work is still in its infancy. We also think corporations are likely to be stickier than web3 dapps or individual users given jointly developed IP and B2B relationships, and web2 partners’ reliance on Polygon to essentially manage their crypto initiatives.

The combination of gaming/metaverse and NFTs is extremely powerful. While it’s a stretch today to imagine Disney paying Polygon $100m pa, the NBA Topshots example highlights that it’s reasonable to assume $10m pa at scale.

Turning to gaming, Polygon sees a significant opportunity and has hired a number of experienced executives from the gaming industry, with Polygon Studios led by the exhead of gaming at Youtube. Polygon thinks web3 gaming offers players significant benefits over traditional gaming, such as ownership of in game items, decentralized governance and interoperability. This makes it a prime on-ramp to crypto for millions of tech-native users. Polygon Studios now has over 300 games on the platform and is working closely with leading gaming studios to help them tackle crypto-native problems such introducing tokenomics and NFT ownership in a frictionless manner. Ryan Wyatt, CEO of Polygon Studios, was recently on a podcast talking about the potential to have in game skins as NFTs designed by famous artists, which could be a material revenue generator, most likely for the likes of EA or Activision within a dedicated L1/L2 managed by a partner like Polygon.

Altogether, we think it is fair to assume Polygon could charge web2 partners 10% of incremental value generated (especially if Polygon were building and maintaining the chains), with the average large cap business able to generate $20-50m in incremental value = $2-6m. To date, Polygon has signed high profile partnerships with more than ten household name non-crypto businesses and we can imagine 50-100 businesses at scale, each paying ~$4m pa on average = $300m pa revenue opportunity from non-crypto players.

Making the case, and scaling the offering

We think that business development will be critical for the success of L2 chains in what will likely become a competitive, crowded space. Thus far, Polygon is arguably arguably the most proactive L2 project in terms of BD. They have ~37,000 dApps on the PoS chain alone, with probably ~200+ of those being material at this point, based on our very rough estimates. This ongoing adoption by the Polygon community, coupled with the scalability they are developing with EVMequivalent zero-knowledge rollups, should act as a tail wind for Polygon and gives us confidence that fundamentals should continue to improve.

Central to their investment and expansion thesis has been zero-knowledge (zk) rollups (see appendix for a more thorough explanation). Through four acquisitions, and using the $450m raised earlier this year along with its own token, Polygon is clearly expressing a view that zk-rollups (as opposed to optimistic rollups) will be superior in solving challenges related to throughput, settlement times, cost per transaction and user experience. Zk-rollups are also likely attractive to Polygon in protecting privacy, which is at the core of the zk-proofs approach: with zk, you can prove you know something without ever unveiling the underlying information. The rollout of the zk suite next year also will be helped by extremely low transaction costs and EVM equivalence, which allows projects to easily port their codebase over to Polygon (which is not the case for zkrollup competitor Starkware).Polygon’s first release in the zk-space is called Hermez, an EVM-equivalent zkrollup (see appendix), which went into testnet in July this year. The current projection is for mainnet release early 2023.

Polygon Hermez should be able to handle around 2000 tps, which compares to ~30 tps on the current POS chain. Sequencers (which collect transaction requests) will pay a fee in MATIC to propose batches. To speed up computation, zk-SNARKs will be used to verify the zkSTARK proofs (as STARKS are much more gas intensive). The other flagship products in the zk portfolio are:

- Polygon Zero – originally called Mir and acquired for $400m ($100m and 3m MATIC tokens) in January 2022. Polygon claim to be able to deliver a 100x improvement in throughput using recursive SNARK proofs

- Polygon Miden – an EVM compatible STARK based zk rollup. This is still under development

- Polygon Nightfall – a zk-based privacy chain focused on enterprise/TradFi web3 adoption, built in conjunction with Ernst & Young

- Polygon ID – a decentralized ID platform focused on SNARK based privacy

- Polygon Avail – a data availability layer for use as part of a modular blockchain solution

- Polygon Edge – formerly Polygon SDK and a framework for building EVM compatible chains, scaling solutions and sidechains

- Polygon Supernets – horizontal scaling solution allowing projects to launch their own blockchain, similar to Avalanche subnets

Thoughts on Revenue Generation

Frankly, the investment narrative around the L2 space is somewhat awkward at this point. On the one hand, L2s were designed to solve high Ethereum gas fees and achieved scalability by taking the execution layer off chain with a dramatic cost reduction for users. In that sense, L2s are a resounding success.

But extremely low (and falling) pricing has implications for revenue generation potential. Moreover, price is determined largely as a function of network throughput, so it is difficult to achieve supernormal pricing and therefore returns to validators.

Current revenue generation is ~$50k per day (gas spend), which is burned and this equates to a P/S of ~480x. With EIP-4488, EIP-4844 and full danksharding (discussed below), it is likely the cost per transaction will continue to fall and so volumes will need to dramatically scale (i.e., 100x or more) if the platform is to generate meaningful revenues through gas alone.

Validators will also need to be rewarded sufficiently to ensure network security. They are currently rewarded with MATIC incentives but these are partially used up (circulating supply is ~97% of fully diluted), which is partly driving the foundation to release updated tokenomics later this year and we would expect some dilution to replenish incentives.

Dramatically scaling volumes appears to be in line with Polygon’s wider long-term corporate strategy. The hope is that with the dramatic reduction in transaction costs and improvement in throughput, infrastructure costs will decline materially and web3 will have its S-curve moment, much like the web2 space once broadband and mobile internet were established. By achieving early developer, dApp and user mindshare and being a major L2 player in the Ethereum ecosystem, Polygon should be able to achieve and maintain a leading market share.

Clearly, investing in this vision requires something of a leap of faith, and this bull case is likely to take years to materialize. Revenue generation is a challenge across the entire L1/L2 space, and investors are perhaps justified in being skeptical of Polygon’s future revenue generating potential. That said, we believe Polygon is as well placed as anyone to execute here and actually monetize volumes.

Other possible routes to long-term token value accretion could be from staking demand and possibly from the use of MATIC as a currency much like ETH on the L1, which would drive value through utility demand (though we think ETH will be hard to displace within the wider ETH ecosystem). MEV is likely to be lower at the L2 level given it is more challenging to reorder transactions, but there may be some opportunities.

Taking an Alternative Approach to Pricing?

Other possible routes to long-term token value accretion could be from staking demand and possibly from the use of MATIC as a currency much like ETH on the L1, which would drive value through utility demand (though we think ETH will be hard to displace within the wider ETH ecosystem). MEV is likely to be lower at the L2 level given it is more challenging to reorder transactions, but there may be some opportunities.

In this sense, it becomes important to ‘own the user’ and so offering a user-friendly, low-complexity, gas-free experience will be part of this. As an extreme example, Apple ‘owns’ the end user through its iOS and the iPhone hardware ecosystem, which enables it to take rent from app developers in exchange platform access. Offering L2 infrastructure likely also creates some degree of user stickiness/composability for the next cohort of users who are ultimately looking for an ‘it just works’ experience.

This dovetails nicely with Polygon’s push into web2, providing a white label blockchain to traditional businesses potentially in return for some form of rent. We can imagine Disney using a dedicated supernet for gaming, trading Disney NFTs or buying merchandise or content, either with MATIC, ETH or Disney Coin. Brick-and-mortar retailers could use a dedicated zero/low fee supernet as a payment solution, embed loyalty programs or even launch their own stablecoins, which would allow them to earn a yield on the underlying collateral (something significantly more attractive given the recent moves in rates markets).

As we outlined above, we think the potential revenue opportunity from web2 partners could be in the region of ~300m. In terms of sizing the web3 opportunity, there are currently 37,000 dApps using Polygon POS, within which there are currently around 35 with a TVL above $5m. If we assume industry pricing is turned on its head and Polygon were in a position to charge dapps rather than end users, we think it is reasonable to assume $1-5m pa for premium L2 access for the average project, which is in line with average sums paid by large DeFi apps to the highest value third party service providers and significantly less than top DeFi projects pay in terms of liquidity incentives (eg LDO liquidity incentives are roughly $150-200m pa). On a 3-5 year basis, we think it is reasonable to assume 100-500 projects on Polygon at this scale, and so a total revenue opportunity of ~$900m pa.

In total then, if pricing is moved to the application level, we estimate the realistic bull case revenue opportunity from web2 and web3 to be in the region of $1bn pa by around 2027, but crucially this depends on Polygon being able to ‘own’ the end user to some extent, or at the very least create material B2B ecosystem effects/ composability. This is clearly no easy task.

L1 costs and the impact of EIP-4844

Another aspect to this debate is L1 call data costs. Currently, Polygon has the lowest costs per transaction (~0.1c vs 1-5c for Optimism/Arbitrum), which is partly a function of being able to scale transactions per interaction with Ethereum L1, or more specifically the L1 call data costs.

We think Polygon’s material cost advantage versus other L2s should help in terms of taking market share across users and projects. The zk-solutions discussed above also are very promising here and should continue to reduce costs, at least once scale is achieved.

Going into 2023, the Ethereum community will be focusing on EIP-4488, which should be implemented as part of the Shanghai upgrade most likely in Q3 2023. This should result in a five-times reduction in call data costs and we will be followed by EIP-4844 (ProtoDanksharding) and Danksharding. These upgrades essentially allow for larger and cheaper transactions with the L1, initially by packaging transactions as ‘blobs’ (binary large objects), which dramatically improves scaling.

It is expected that Danksharding will initially drive a roughly 10-20x improvement in throughput for L2s and as such should drive a huge reduction in L1 transaction costs. Currently, cost per transaction for Polygon POS is ~0.1c; in time, costs should become increasingly negligible on Hermez and Mir mainnet, but the upgrades to Ethereum’s throughput via L2s may have a relatively more significant impact for competitor L1s such as Arbitrum and Optimism which currently pay away 50%+ of their transaction fees to the L1 (and therefore may be negative for Polygon’s share in a relative context at least). Following EIP-4844 the Ethereum community will work toward full Danksharding, which is forecasted to increase Ethereum’s throughput to ~100k tps or more. We expect this will lead to significant cost reductions across the entire L2 space, and while Polygon may remain the L2 cost leader (dependent on effectiveness of its zk solutions), frankly it may not matter at such low transaction costs.

Taking all of that into account, the likely endgame is that all of the major L2 players will be able to offer extremely high throughput at negligible cost to users. As a result, this infrastructure will likely become commoditized, much like broadband internet. Success and share will be primarily driven by business development, which is ideal for Polygon given their business development focus and first-mover advantage.

Thoughts on valuation

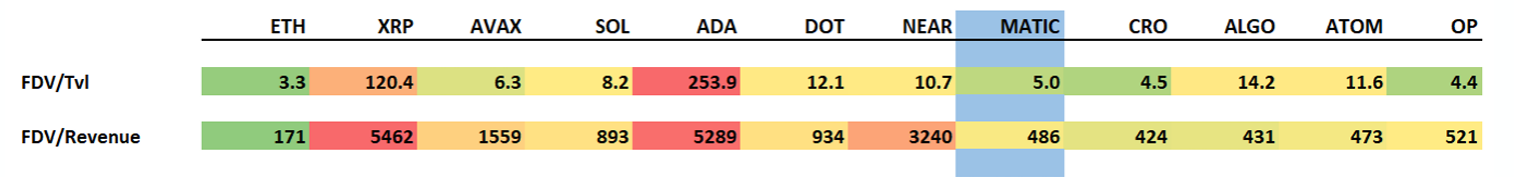

MATIC (the tokens are used to govern and secure the Polygon network and pay transaction fees), currently trades on ~480x P/S. This is roughly in line with the rest of the L1 space but compares to ~170x for Ethereum. However, MATIC looks much more attractive on an FDV/ TVL basis as below.

As we see it, MATIC is an asymmetric long-term play on “mass market crypto” and so our valuation approach is to attempt some (admittedly rough) medium-term revenue estimate and then to discount accordingly.

What could that be in 2027? Assuming a couple of plausible ‘killer apps’ to model revenue from gas alone:

- Payments: Visa processed 165bn transactions in 2021 (150x that of Polygon). This would imply $2.25bn pa at current transaction costs of 1c, or $200m at a 10x price reduction. Even at current costs, this is significantly lower than current per transaction fees on the major payment networks (average 15c for Visa)

- Gaming: there are ~60m monthly active users of Fortnite, so assuming similar success for a web3 game in which users pay $1-5 per month for ‘all you can eat’ gas package implies $1.5-2bn pa

As discussed, we think an alternative (or possibly complementary) web2/web3 dapp payer model (i.e., free gas to users) could realistically generate $1bn pa. Altogether, we think a bull case revenue target in 2027 of $1-5bn is reasonable. For context, the gas spend on Ethereum hit $1.9bn in November alone, with only 8-9m active addresses. On that basis, MATIC is trading at 2-3x our realistic bull case 2027 P/S.

Another approach is to think about the value split between L1/L2s. One argument from the bull camp is “if ETH trades at $160bn, $7.5bn for MATIC is the wrong price.” We can think about this in terms of 1) Fair L1/L2 value split and 2) What share of that Polygon should have at scale.

On the first point, we see ETH L1 retaining its role as the data availability and consensus layer, with a range of L2s providing execution to the vast majority of users, with only high-value transactions remaining on L1 (eg blue chip NFTs or enterprise level financial transactions). We think ETH L1 (rather than the L2 ecosystem) should continue to retain the majority of overall transaction revenue (and should retain all the monetary/utility value - i.e. ETH as money), though transaction costs should fall dramatically at both the L2 and L1 level. This could possibly be offset by those L2s smart enough to ‘own the user’ through wallets (and perhaps RPC nodes/ MEV), though this is hard to predict.

Overall, we would expect something of a relative shift in the value share away from L1s toward the L2 group, though with Ethereum benefitting in absolute terms through higher transaction volumes and use of ETH as money. On that basis, we would say that if the current valuation is roughly $200bn ETH / $30bn+ for the major L2 players post STARK and Arbitrum airdrops (MATIC, OP, STARK, Arbitrum), ie ~85/15, perhaps this mix should be approaching 70/30 over time.

If we then think about the relative share within that group, clearly there will be a number of L2 competitors, but we see maybe 4-5 with significant oligopolistic share and so at scale we would see Polygon with ~20% of the L2 market. On that basis, in current ETH market cap terms this would imply a valuation of ~$11bn ($160bn 30% 20%). So based on current activity and ETH valuation alone, we would say there is ~50% upside to MATIC, at least relative to ETH.

Upcoming Catalysts

MATIC has traded roughly in line with the wider L1 space for most of this year, though it has been one of the stronger performers over the last couple of months. We see a number of potential catalysts over the next few months which we think could cause the token to perform.

With the merge behind us, the Ethereum community will begin to focus on EIP-4488 and EIP-4844 (‘the surge’) and the L2 plays will likely benefit from the narrative of significantly higher L2 throughput and lower L1 costs.

Similarly, over the next few weeks or months we should see the restart of the Arbitrum Odyssey program, during which time users will be incentivized to complete a range of activities on Arbitrum’s core dapps, beginning with GMX. This should drive hype and focus toward the L2 names and frankly this is already underway.

This Autumn, Starkware should also be launching a token. Starkware is a zk-based L2 and we expect this will lead to a wave of positive sentiment for zk-rollups, with the only other pure play being MATIC. Note that the STARK token will not be airdropped to users and therefore there will have very limited initial circulating supply (and also fewer potential sellers), which could possibly be favorable for STARK valuations and therefore MATIC by proxy. Early next year we should also expect the release of Polygon Hermez on mainnet and would expect the release of Polygon Hermez on mainnet and would expect significant positive sentiment into that release.

Lastly on the more negative side, we believe that within two months or so Polygon will be releasing updated tokenomics, we believe within two months or so. We do not know any details at this point but we expect fully diluted tokens to increase to provide fresh tokens for validator rewards. This should at least partially dilute existing tokenholders (much like an equity issuance for a stock), which may be taken somewhat negatively by the market, though much depends on the scale of any increase.

Summary

L2s are critical to the long-term scaling of Ethereum and this places projects like Polygon in a strategically important position. We think L2 success will primarily be a function of business development rather than technology. As discussed in this paper, we think Polygon is arguably one of the most competent L1/L2 projects in this regard, with some extremely impressive executives who are well-positioned to win. Similarly, the next wave of crypto users will likely be less concerned about (or even aware of) which technology they are using. Instead, they will be looking for a slick, frictionless experience that just works and at this point, gaming appears to be the most likely source for an emerging ‘killer app’ to on-ramp this new user base, especially given there are over 3bn gamers worldwide.

Right now, the strategic focus is on dapp/dev/user acquisition, but in time we expect to see a shift in focus towards monetization. What form this takes is still unknown, but there are a number of realistic options, including scaling user level gas micro-payments, ‘all you can eat’ gas packages to abstract away friction, or charging web3 dapps and web2 partners directly. The early progress on web2 partnerships is extremely encouraging, and we expect Polygon to become a critical partner and enabler for non-web3 companies as they begin to move into blockchain initiatives. As discussed, we think the revenue opportunity has the potential to be in the region of the low billions of dollars annually on a 5- year view if the team can execute on monetization, but this is clearly no easy task given most L1s/L2s (other than Ethereum) have struggled to deliver material revenue generation.

Appendix

EVM Equivalence/Compatibility

EVM compatibility means that the L1 contract for the L2 solution, which commits and verifies the bundles of transactions, does not implement the EVM itself. This allows for faster project deployment and reduces gas usage but it does often require code modifications. EVM equivalence on the other hand means that the L2 is fully compliant with Ethereum bytecode. This results in far better compatibility in the L2 compared to EVM compatibility and is generally considered to be the future direction of L2s. In a recent post, Vitalik Buterin wrote about 4 levels of EVM equivalence, with Type 1 being fully equivalent, through to Type 4 which avoided costly overhead by not zk-proving the different parts of each execution step. Polygon believe their zk-EVM is a Type 3 solution, working toward a Type 2.

ZK-Rollups

Zero-Knowledge rollups are a type of Ethereum scaling solution that perform computations and state-storage off-chain, batch transactions together, and submit them, along with a proof of their validity, to the Ethereum main chain. Optimistic rollups function in a similar fashion, however they use fraud proofs - instead of submitting a validity proof, all transactions are transactions are assumed to be valid and can be challenged after being submitted. Both techniques are still being heavily researched and come with their own set of tradeoffs.

Author:

- Steve Goulden, London, sgoulden@cumberland.io

For more information, please contact your local Relationship Manager:

- Paul Kremsky, Singapore, pkremsky@cumberland.io

- Aaron Armstrong, London, aarmstrong@cumberland.io

- Thai Ming Bong, Singapore, tmbong@cumberland.io

- Matt Connelly, Chicago, mconnelly@cumberland.io

- Wilson Huang, Greenwich/New York, whuang@cumberland.io

- Daniel Lim, Singapore, dlim@cumberland.io

- Nathalie Ngo, Toronto, nngo@cumberland.io

- Alex Williams, London, atkwilliams@cumberland.io

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements. Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

Cumberland SG Pte. Ltd. is exempted by the Monetary Authority of Singapore (“MAS”) from holding a license to provide digital payment token (“DPT”) services. Please note that you may not be able to recover all the money or DPTs you paid to a DPT service provider if the DPT service provider’s business fails. You should not transact in a DPT if you are not familiar with the DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider. You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. You should be aware that your DPT service provider, as part of its license to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoins.”